Although millennials are not aggressive investors, the effects of the market crash shaped them to become fervent savers. Only 14% of millennials report not having any type of savings or investments, according to the Legg Mason report.

The political climate and threat of Social Security drying up have also influenced younger generations to focus on financial retirement goals. A Merrill Lynch report found millennials expect 65% of their retirement income to be covered by personal sources (such as personal savings accounts or family inheritance), with 29% coming from savings and investments, 24% from continued employment after retirement and 12% from family (other than a significant other).

Although most millennials are already actively saving for retirement, they may fear they’re not saving enough. According to the Legg Mason survey, 41% of millennials live for today but would like to plan more for tomorrow. And only 13% are striking a financial balance between living for today and investing for tomorrow.

Financial institutions should be optimistic about this potential new clientele because they clearly demonstrate not only a willingness, but also a hunger to be more investment-savvy — they just need someone to show them the way.

Big tech vs. big banks

In spite of concerns over privacy and security, it turns out millennials put more trust in technology than they do in banks. A study by Vested uncovered that millennials trust big tech over big banks 34% to 20%.1 But don’t interpret that as bad news for financial services. Digital innovation is rocking the financial industry — and millennials are all in.

The evolving dynamic between financial services and technology has added a new word to our vernacular: fintech, short for financial technology. Mobile banking has spawned a revolution of fintech innovation with apps such as Apple Pay, Google Wallet (now Google Pay), Venmo, Square and many more.

At least eight in 10 millennials manage their finances digitally, says Gallup.2 Mobile now dominates digital banking over desktops, up 5% from 2017, based on a report by PwC.

But it’s not just the technology platforms that are changing the way millennials handle money.

Because of their fluency and trust in technology, up-and-coming generations are very receptive to Artificial Intelligence (AI) to guide their financial decisions. A Future of Banking Survey by Varo Money (a mobile-only bank) found that 85% of millennials agree AI could help them manage their finances and reap such benefits as:

- Savings plan calculations and execution (36%)

- Clearer visibility into spending (30%)

- Fewer financial errors (29%)

- Unbiased advice (29%)

Nearly nine in 10 millennials (89%) would like AI tied to mobile banking, primarily for:

- Automatic bill pay (47%)

- Cash flow analysis (47%)

- Automatic savings (43%)

- Consolidating account visibility (42%)

- Spend pattern analysis (41%)

See it in action: Learn how a financial services client engaged a new generation of customers with a chatbot in this case study.

A love-hate relationship with financial institutions

Millennials have a reputation for being brand-loyal, but the financial industry seems to be the exception. According to the Gallup report, 69% of millennials are disengaged from the banking industry.2

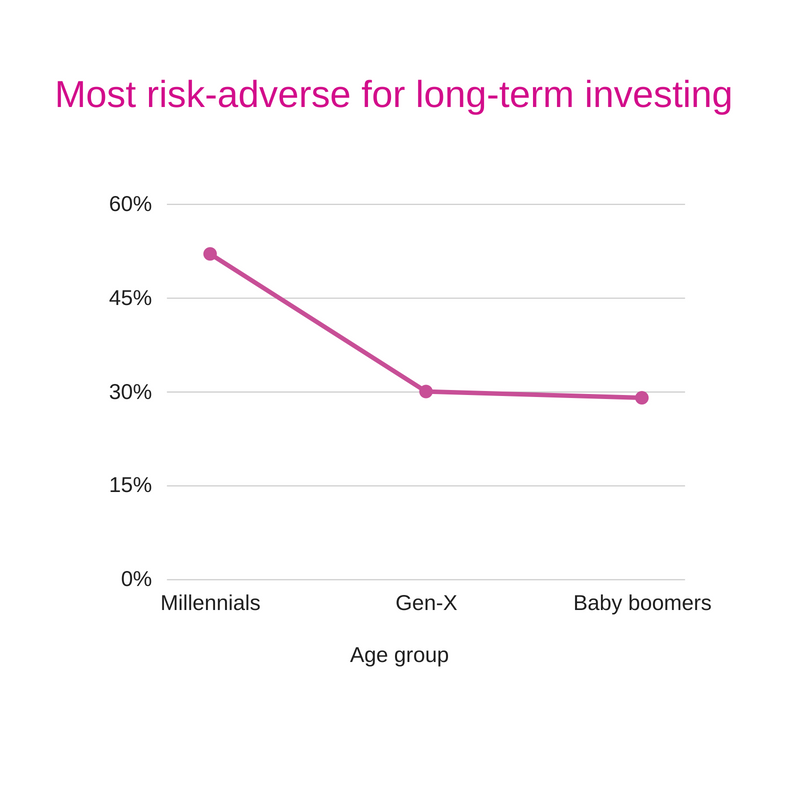

This emotional or psychological detachment makes changing banks a non-issue, and millennials are far more inclined to switch banks compared to any other age group — a trend that’s likely to continue among younger demographics. In fact, 8% of millennial customers report moving to a new primary bank more than double the rate (2.5 times) of baby boomers and 1.5 times more often than Gen Xers.

Let’s get phygital.

Over the last few years, companies in every industry have been racing to cross the digital divide to provide a user-friendly experience online. But today, customer loyalty requires more than optimal digital experiences. The new critical mission is to deliver a seamless blend of digital and physical experiences — otherwise known as “phygital.”

Here’s an example: See the capabilities and benefits of a chatbot in this infographic.

Continuity of experience has been an elusive goal for many larger institutions with multiple business units such as a commercial bank with business lending, consumer credit, mortgage and more. In some cases, these business units have been acquired and the operations did not lend themselves to digitization. Companies that arose in the age of the internet — take Mint, for example — have had a distinct advantage, while legacy institutions have struggled to catch up.

Having grown up with the internet and Google, millennials feel empowered and self-sufficient to perform their own research and seek out opinions from others. This tech-savvy generation is extremely comfortable with digital exchanges, such as email or live chat. Through these channels, they can take a “choose your own adventure” route with instant gratification of finding the information they want, in the moment they want it.

And rising fintechs such as Stash and Robinhood — investment and trading apps tailored for the novice investor — have capitalized on this.

However, human roles such as personal bankers or financial advisors won’t be going away any time soon. The Legg Mason survey revealed 82% of all respondents agree personalized, face-to-face customer service is important and can’t be replaced by technology. And even though millennials have been the driving force behind financial digital innovation such as mobile banking, 65% of consumers still value having a local branch, according to the PwC survey.

The takeaway

Financial institutions must master the seamless handoff, combining intuitive digital tools and advice with direct, in-person service. The PwC report confirms 73% of consumers across all generations begin a digital research journey of investment products before connecting with a person. The key is to become the invisible hand by creating phygital experiences that enable frictionless, multichannel exchanges.

Figure 1. Source: Legg Mason 2017 Global Investment Survey

Figure 1. Source: Legg Mason 2017 Global Investment Survey